Login

Register

Password

Forgot Password?

Forgot Email?

Logo

Welcome User

$4000 Deductible Remaining

$1000 paid

Education

56789234

Member ID

56789234

Group ID

Policy Number

210384708

Effective Until

12/31/2023

Welcome Ellie!

Summary of Spending

Learn Terms

Quiz

Learn Policy Terms Quickly

Allowed amount - maximum amount your insurer will pay for covered services.

Balance Billing - Difference between allowed amount and what your employer charges.

PCP - Your primary care physician or primary care provider who oversees your health care.

Benefit/Plan - health care services covered by your plan

Carrier - Company that provides your health insurance

Network - A list of providers that your plan contracts with, which includes in-network and out-of-network.

Copay - a set fee you pay for a doctor visit or prescription. You typically pay it at your appointment or when you pick up a prescription.

Coinsurance - the amount you pay for covered health care after you meet your deductible.

Out of pocket maximum -a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year.

Benefit Year - How long your benefits are good for. Typically one year.

Learn Terms

Premium - The amount you pay for your health insurance every month.

Deductible - The amount you pay for covered health care services before your insurance plan starts to pay.

Rx coverage - amount your health plan pays for prescription drug coverage.

Cost sharing - Your portion of the bill, which may include coinsurance, copayments, deductibles, or similar charges.

Take Quiz

What is the amount you pay for you health insurance every month?

Copay

Premium

Rx coverage

Congrats!

You got the question right!

Next

Incorrect!

That was the wrong answer.

Next

Final Prototype

Health Insurance Quiz App

Background:

The Health Insurance Literacy App was created as a way for young adults ages 18-35 to learn more about the ins and outs of their health insurance policy, to avoid confusion in the future.

Problem Statement

Secondary Research

Primary Research

Empathize

Define

Problem Statement

Secondary Research

Research Objectives

Assumptions

Interviews

Affinity Clustering

Insights

Final Insight

55% of Americans do not understand their health insurance policies, including terms, coverage, and cost. Americans are hesitant to sign up for health insurance policies due to this confusion and this also causes a delay or avoidance in treatment. My goal is to provide a platform where Americans, particularly young individuals in their 20’s, can understand their health insurance policies without hesitating to sign up for a plan or lack of knowledge about insurance terms.

61% of young Americans confused premium with deductible

71% of young Americans confused premium with deductible

Americans waste $110 a month not understanding their insurance plan

People avoid care due to lack

of knowledge of their health insurance

policy

People pay extra money thinking this will provide extra coverage

Young individuals in their 20’s do not understand their health insurance policy due to being on a family member’s insurance for a long time

Participant 1

Participant 2

Participant 3

Age: 27

Age: 26

Age: 29

Occupation:

Social Worker

Health Insurance:

Yes

Nationality:

American

Nationality:

American

Nationality:

American

Health Insurance:

Yes

Health Insurance:

Yes

Occupation:

Government

Worker

Occupation:

Financial Analyst

“I know enough about health insurance, but not everything.”

“I’m not sure about several terms in health insurance.”

“Health insurance isn’t really my area of expertise.”

Pain points

Motivations

Behaviors

Major Themes

I’m not really sure about OOPM and I don’t know what coinsurance is

I don’t have the best understanding about coinsurance

I go online to look up what the terms mean

I only use my insurance twice a year

I’ve only learned about health insurance through things my parents have told me

TikTok videos explain you benefits and what they mean

Uncertainty of some of the terms

Tools like the internet of TikTok is available

Young Americans learn about their health insurance benefits through their employer’s information sessions. They also rely on their parents and knowledge from school to make decisions.

Young Americans use digital tools such as the internet or Tik Tok to learn more or answer any questions about insurance. However, some young Americans prefer face to face interaction when answering tough questions.

Young Americans understand most health insurance terms, but are not confident in their knowledge.

Young Americans get most information about their benefits, such as health insurance, from their employers and rely on past knowledge from parents or school to understand their benefits. Digital Tools are often used to fill in the gaps of areas they do not understand.

After empathizing, I gathered all the research I found and started defining a How Might We question along with a persona.

How Might We...

How might we create a supplemental tool that provides an easy way to check information on health insurance on a digital tool to aid employers in explaining their benefits?

User Persona

Ideate

User Stories

Knowledge

Responsibility

Money

Gather information

in one stop

Administration Issues

Example of user story from Knowledge Epic: As an employee, I want to quiz myself on how much I have learned about my health insurance policy, so that I can feel confident in what I’m paying and know I am getting good quality coverage.

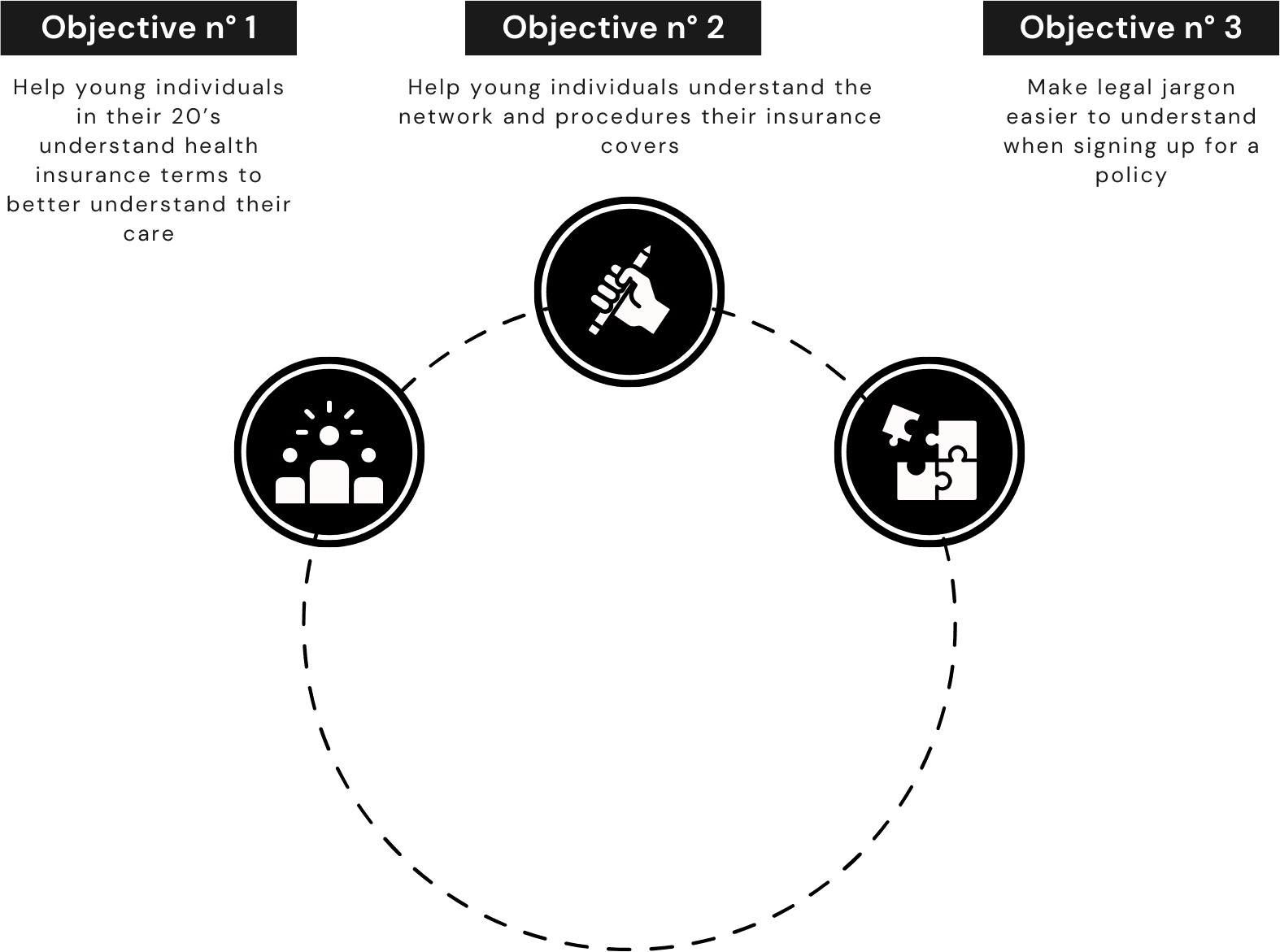

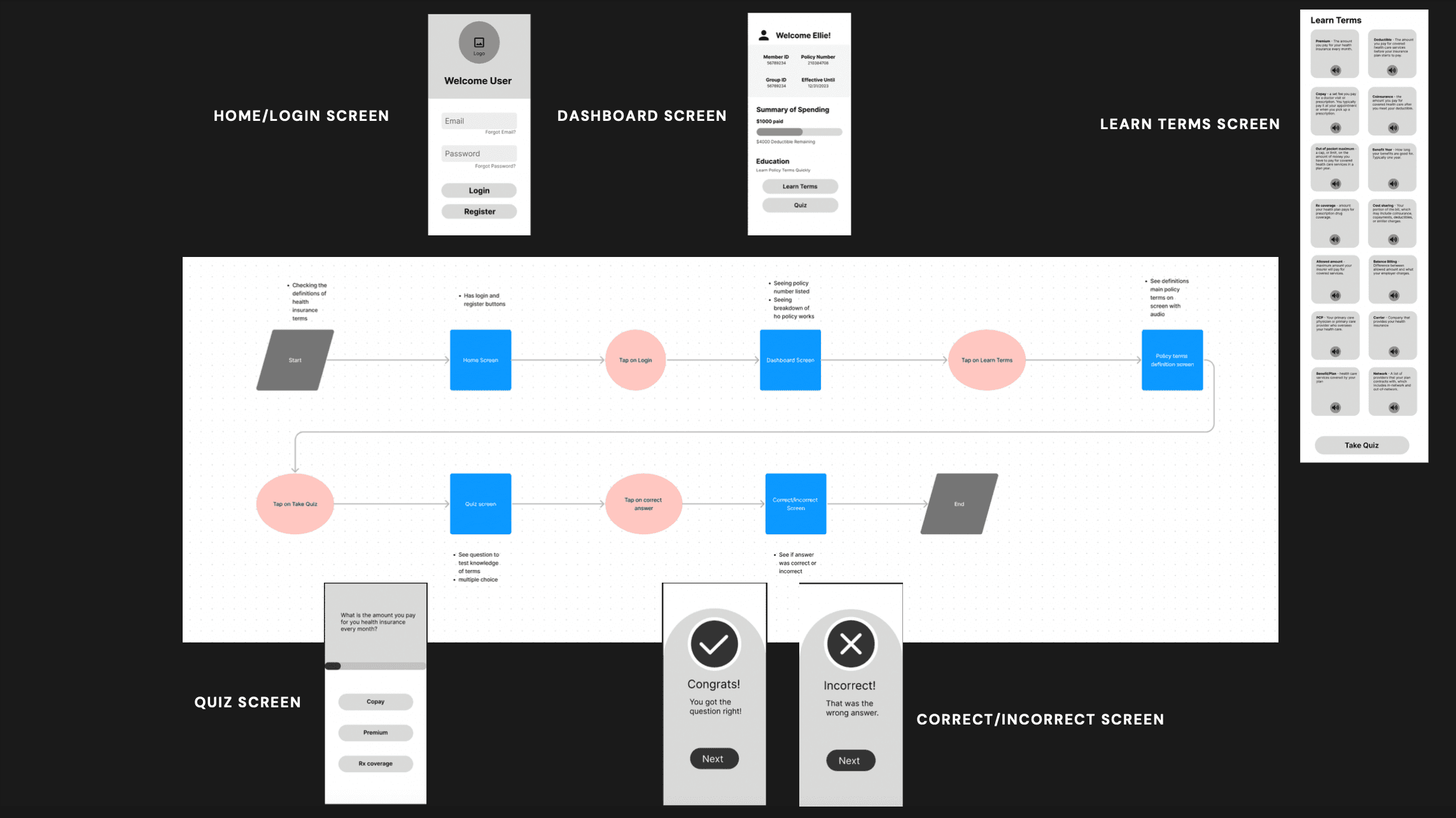

Task Flows

I created a task flow based on the chosen epic to create a task flow to help users quiz themselves on how much they’ve learned about their health insurance policy.

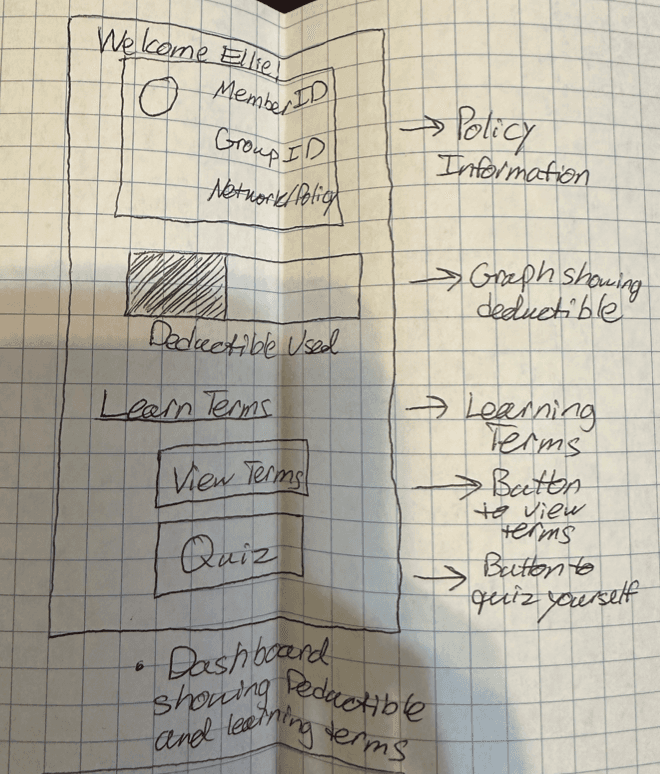

Sketches

Wireframes

Prototype

Login

Register

Password

Login

Register

Password

Member ID

Group ID

Network/Policy

$1000/$5000 Deductible Used

Education

Learn Terms

Quiz

56789234

34786493

210384708

Member ID

Group ID

Network/Policy

$1000/$5000 Deductible Used

Education

Learn Terms

Quiz

56789234

34786493

210384708

Copay - a set fee you pay for a doctor visit or prescription. You typically pay it at your appointment or when you pick up a prescription.

Coinsurance - the amount you pay for covered health care after you meet your deductible.

Out of pocket maximum -a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year.

Benefit Year - How long your benefits are good for. Typically one year.

Rx coverage - amount your health plan pays for prescription drug coverage.

Cost sharing - Your portion of the bill, which may include coinsurance, copayments, deductibles, or similar charges.

Learn Terms

Premium - The amount you pay for your health insurance every month.

Deductible - The amount you pay for covered health care services before your insurance plan starts to pay.

Take Quiz

Copay - a set fee you pay for a doctor visit or prescription. You typically pay it at your appointment or when you pick up a prescription.

Coinsurance - the amount you pay for covered health care after you meet your deductible.

Out of pocket maximum -a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year.

Benefit Year - How long your benefits are good for. Typically one year.

Rx coverage - amount your health plan pays for prescription drug coverage.

Cost sharing - Your portion of the bill, which may include coinsurance, copayments, deductibles, or similar charges.

Learn Terms

Premium - The amount you pay for your health insurance every month.

Deductible - The amount you pay for covered health care services before your insurance plan starts to pay.

Take Quiz

Copay

Rx coverage

Premium

What is the amount you pay for you health insurance every month?

Congrats!

You got the question right!

Next

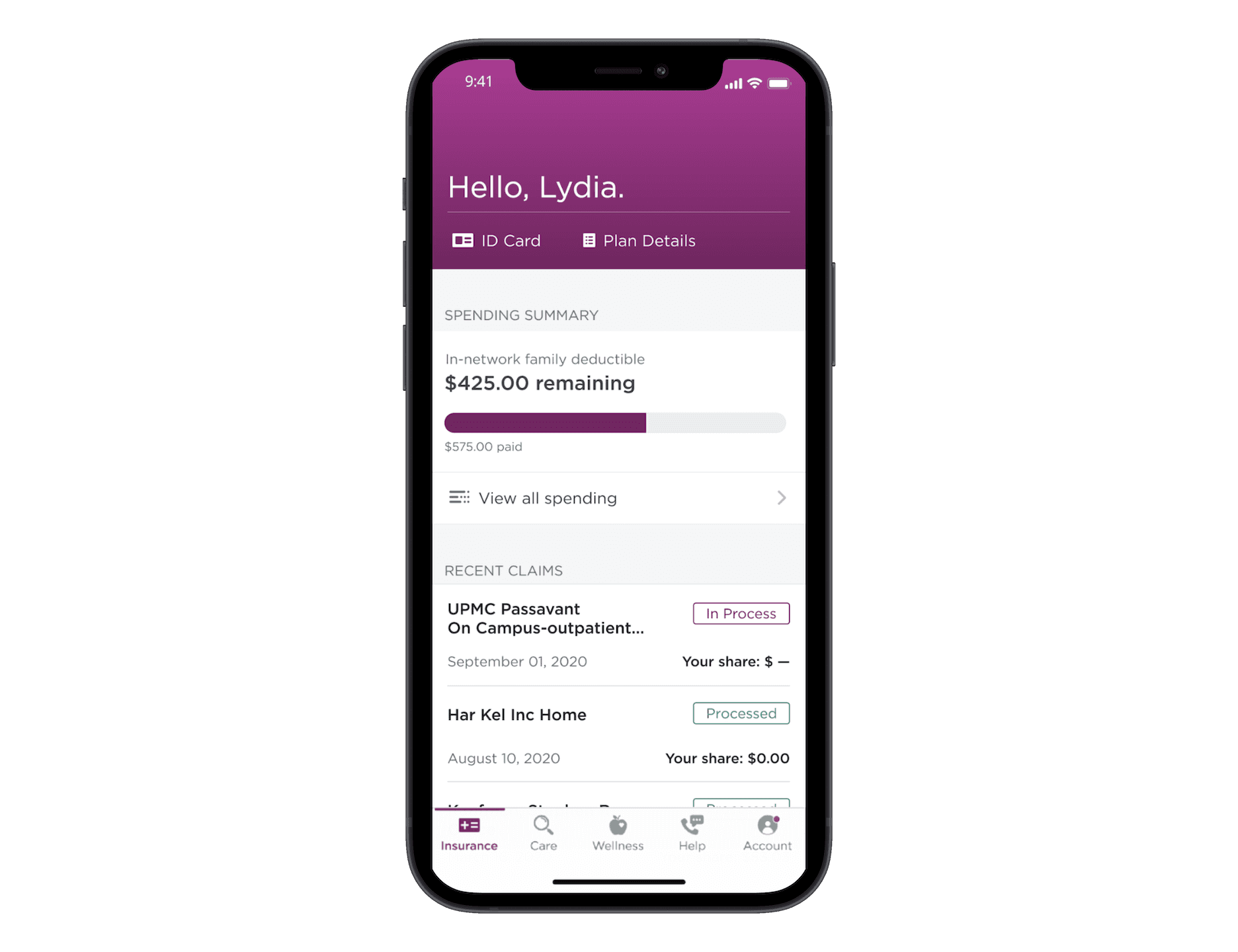

UI Inspo

Sketch

Wireframe

Testing

Test:

Scenario: Imagine you are employed by a large firm and just got brand new health insurance.

Task: Tell me how you would check how much of your deductible was used. Can you provide me with a number?

Task: Now you want to check details of your policy. Can you read off your policy number?

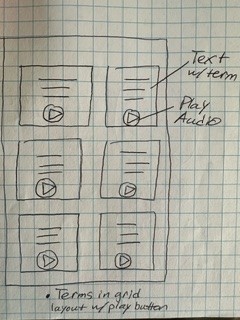

Task: Where would you go to audibly listen to any term definitions?

Task: Once you have listened to the terms take the quiz.

Logo in front

is not clear

Button size

was too big

Button size

was too big

Profile picture

is hard to

discern

Audio icons were not

clear, users thought it

could mean video

App was too

text heavy

Login

Register

Password

Forgot Password?

Forgot Email?

Logo

Welcome User

Login

Register

Password

Forgot Password?

Forgot Email?

Logo

Welcome User

Initial Prototype

Initial Prototype

Initial Prototype

Initial Prototype

NO FEEDBACK

Final Prototype

Final Prototype

Final Prototype

Final Prototype

User Feedback

Button size

was too big

User Feedback

User Feedback

User Feedback

Member ID

Group ID

Network/Policy

$1000/$5000 Deductible Used

Education

Learn Terms

Quiz

56789234

34786493

210384708

$4000 Deductible Remaining

$1000 paid

Education

56789234

Member ID

56789234

Group ID

Policy Number

210384708

Effective Until

12/31/2023

Welcome Ellie!

Summary of Spending

Learn Terms

Quiz

Learn Policy Terms Quickly

$4000 Deductible Remaining

$1000 paid

Education

56789234

Member ID

56789234

Group ID

Policy Number

210384708

Effective Until

12/31/2023

Welcome Ellie!

Summary of Spending

Learn Terms

Quiz

Learn Policy Terms Quickly

Allowed amount - maximum amount your insurer will pay for covered services.

Balance Billing - Difference between allowed amount and what your employer charges.

PCP - Your primary care physician or primary care provider who oversees your health care.

Benefit/Plan - health care services covered by your plan

Carrier - Company that provides your health insurance

Network - A list of providers that your plan contracts with, which includes in-network and out-of-network.

Copay - a set fee you pay for a doctor visit or prescription. You typically pay it at your appointment or when you pick up a prescription.

Coinsurance - the amount you pay for covered health care after you meet your deductible.

Out of pocket maximum -a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year.

Benefit Year - How long your benefits are good for. Typically one year.

Learn Terms

Premium - The amount you pay for your health insurance every month.

Deductible - The amount you pay for covered health care services before your insurance plan starts to pay.

Rx coverage - amount your health plan pays for prescription drug coverage.

Cost sharing - Your portion of the bill, which may include coinsurance, copayments, deductibles, or similar charges.

Take Quiz

Allowed amount - maximum amount your insurer will pay for covered services.

Balance Billing - Difference between allowed amount and what your employer charges.

PCP - Your primary care physician or primary care provider who oversees your health care.

Benefit/Plan - health care services covered by your plan

Carrier - Company that provides your health insurance

Network - A list of providers that your plan contracts with, which includes in-network and out-of-network.

Copay - a set fee you pay for a doctor visit or prescription. You typically pay it at your appointment or when you pick up a prescription.

Coinsurance - the amount you pay for covered health care after you meet your deductible.

Out of pocket maximum -a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year.

Benefit Year - How long your benefits are good for. Typically one year.

Learn Terms

Premium - The amount you pay for your health insurance every month.

Deductible - The amount you pay for covered health care services before your insurance plan starts to pay.

Rx coverage - amount your health plan pays for prescription drug coverage.

Cost sharing - Your portion of the bill, which may include coinsurance, copayments, deductibles, or similar charges.

Take Quiz

Copay

Rx coverage

Premium

What is the amount you pay for you health insurance every month?

What is the amount you pay for you health insurance every month?

Copay

Premium

Rx coverage

What is the amount you pay for you health insurance every month?

Copay

Premium

Rx coverage

Congrats!

You got the question right!

Next

Congrats!

You got the question right!

Next

Incorrect!

That was the wrong answer.

Next

Incorrect!

That was the wrong answer.

Next

Role:

Project:

Tools:

Lead UX Researcher/Designer

BrainStation Student Project

Design Thinking Process

I utilized a design thinking process to execute a well-designed app. This approach was very user focused and allows me to understand the users’ needs before hand.

Empathize

Define

Ideate

Prototype

Test

How might we?

User Persona

User Stories

Task Flows

Sketches

Wireframes

Usability Testing

Incorrect!

That was the wrong answer.

Next

Low effort

High value

Low value

High effort

Logo in front

is not clear

App was too

text heavy

Button size

was too big

No way to tell

between primary

and secondary

button

Audio icons were not

clear, users thought it

could mean video

Profile picture

is hard to

discern

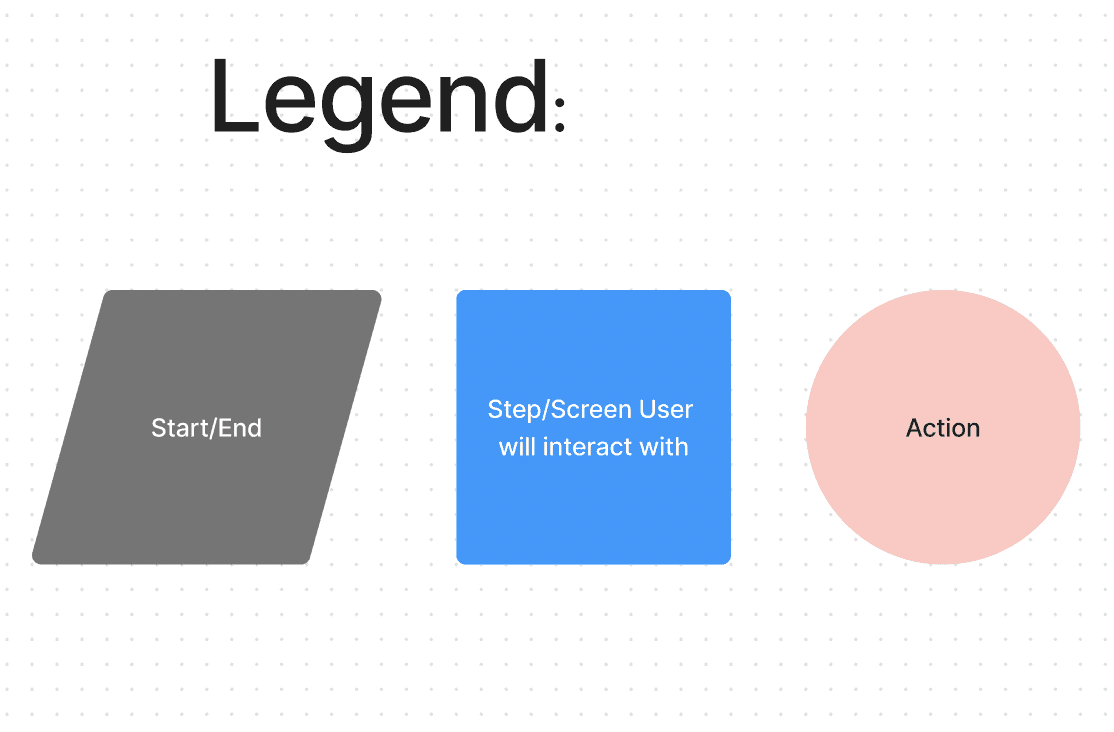

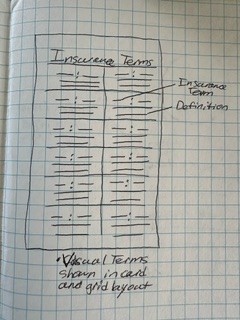

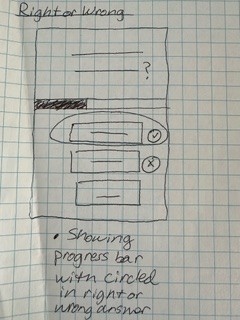

I created 24 sketches, with annotations, showing the process of how a user would quiz themselves as a way to learn health insurance policy terms, using more interactive ways to learn, such as audio. I displayed 3 of these sketches below.

I created user stories based on my persona and divided them into 5 epics. I focused on the knowledge epic to focus on helping users learn the terms of their health insurance policy.

I took my research and captured key findings, pain points, motivations, and behaviors by creating a user persona. The persona represents the culmination of key insights.

After conducting interviews and surveys, I organized observations into pain points, motivations and behaviors. I then grouped them into themes to create insight statements.

I interviewed 3 individuals about how much knowledge they have about their health insurance policy and where they receive information about it. I tried to grasp how they receive education and seek knwoledge about their policies.